Cash-Strapped? Tribal Loans: Friend or Foe?

Cash-Strapped? Tribal Loans: Friend or Foe?

You’re in a bind. Bills are piling up, and your bank account is looking pretty bare. You’ve tried everything – cutting back, asking for an extension – but nothing seems to work. Then you see it: an online ad promising quick cash with "easy approval" and "no credit check." It’s a tribal loan. But is it really the answer to your prayers, or just another financial trap?

Let’s break down the world of tribal loans, exploring what they are, how they work, and whether they’re right for you.

Related Articles: Cash-Strapped? Tribal Loans: Friend or Foe?

- Are Tribal Loans Legal In Indiana? The Wild West Of Lending Explained

- Stuck In A Credit Crunch? Tribal Loans Might Be Your Lifeline (But Read This First!)

- Are Tribal Loans Safe? Unmasking The Truth Behind The Hype

- Indian Tribal Loans Direct LendersTitle

- Stuck In A Credit Rut? Here’s How To Get The Loan You Need In India, Even With Bad Credit

The Tribal Loan Landscape

Tribal loans are short-term, high-interest loans offered by lenders based on sovereign Native American tribal land. The tribal sovereignty allows these lenders to operate outside of state regulations that typically govern payday loans. This means they can charge higher interest rates and fees, often exceeding 300% APR, making them incredibly expensive.

Why the Tribal Connection?

You might be wondering, "What’s the connection between Native American tribes and payday loans?" Here’s the deal: tribes have the right to govern themselves on their own land, including financial matters. They’ve used this right to create businesses, including lending institutions. These businesses operate under tribal law, not state law, which means they can sidestep some consumer protections.

The Allure of Tribal Loans

So, why are tribal loans so popular? Well, they offer a few tempting perks:

- Fast Approval: Tribal lenders often tout quick approval times, sometimes even within a few hours. This is appealing for people in urgent need of cash.

- No Credit Check: Many tribal lenders don’t require a credit check, making them accessible to those with bad credit.

- Easy Application: The application process is often streamlined, requiring minimal documentation.

The Hidden Costs

But remember, there’s a reason why these loans are so "easy" to get. Tribal loans come with a hefty price tag:

- High Interest Rates: Interest rates can be astronomical, often reaching 300% APR or more. This means you’ll end up paying back far more than you borrowed.

- Hidden Fees: Be prepared for a variety of fees, including origination fees, late fees, and even fees for using a debit card.

- Debt Cycle: These loans are designed to be short-term, but they can easily trap borrowers in a cycle of debt. If you can’t pay back the loan on time, you’ll be stuck with more fees and interest, making it harder to get out of debt.

The Legal Gray Area

The legality of tribal loans is a bit of a gray area. While they operate under tribal sovereignty, some states have attempted to regulate them. The legal landscape is constantly evolving, and it’s important to be aware of the laws in your state.

Alternatives to Tribal Loans

Before you even consider a tribal loan, explore these alternatives:

- Credit Union Loans: Credit unions often offer lower interest rates and more flexible repayment terms than traditional banks.

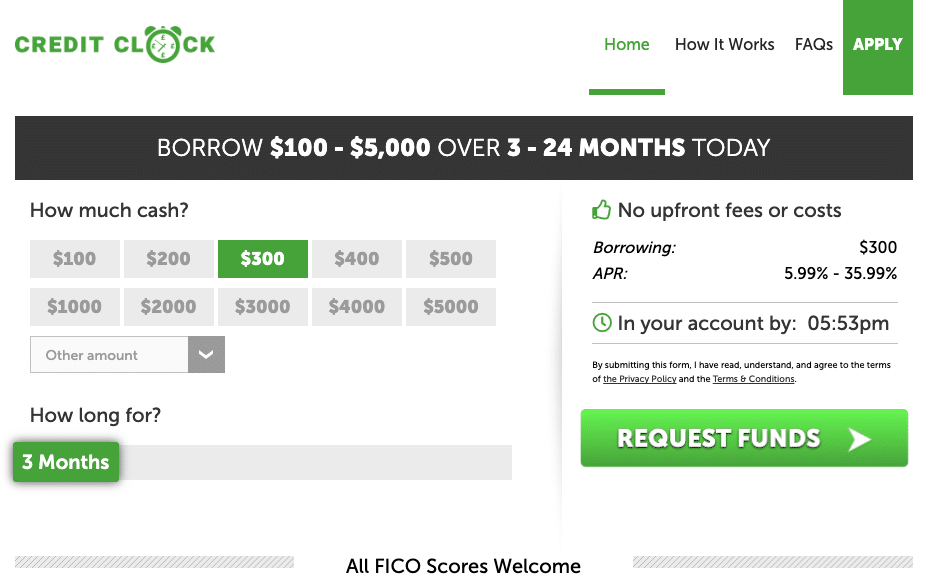

- Personal Loans: Online lenders and traditional banks offer personal loans with competitive interest rates and repayment terms.

- Payday Alternative Loans: Some credit unions offer small, short-term loans with lower interest rates than payday loans.

- Community Resources: Local charities and non-profit organizations may offer financial assistance programs.

The Bottom Line

Tribal loans can seem like a quick fix, but they often come with hidden costs and can trap you in a cycle of debt. Before you take out a tribal loan, consider the alternatives and weigh the risks carefully. It’s crucial to understand the terms of the loan and make sure you can afford to repay it before signing anything.

Is a Tribal Loan Right for You?

Here are some key questions to ask yourself:

- Do you have a legitimate emergency? Tribal loans are meant for short-term, unexpected expenses. If you’re facing long-term financial difficulties, a tribal loan isn’t the answer.

- Can you afford the repayment? Consider the total cost of the loan, including interest and fees. Make sure you can comfortably make the monthly payments without jeopardizing your finances.

- Are you aware of the risks? Tribal loans come with high interest rates and hidden fees. Be prepared for the possibility of debt spiraling out of control.

- Have you explored all other options? Before you resort to a tribal loan, exhaust all other options, such as credit unions, personal loans, or community resources.

Don’t be lured by the promise of quick cash. Do your research, consider the risks, and make an informed decision that’s right for your financial situation.

FAQ: Indian Tribal Loan Companies

Q: Are tribal loans legal?

A: The legality of tribal loans is a complex issue. While they operate under tribal sovereignty, some states have attempted to regulate them. The legal landscape is constantly evolving, and it’s important to be aware of the laws in your state.

Q: How do I know if a lender is a tribal lender?

A: Look for clues on the lender’s website, such as references to a specific tribe or tribal land. You can also contact the lender directly and ask about their tribal affiliation.

Q: What are the risks of taking out a tribal loan?

A: Tribal loans come with high interest rates, hidden fees, and the risk of falling into a debt cycle. You could end up paying back far more than you borrowed.

Q: What are some alternatives to tribal loans?

A: Consider credit unions, personal loans, payday alternative loans, and community resources. These options often offer lower interest rates and more flexible repayment terms.

Q: What should I do if I’m struggling to repay a tribal loan?

A: Contact the lender immediately and try to negotiate a repayment plan. You may also want to consider seeking help from a credit counseling agency.

Remember, tribal loans should be a last resort. Make sure you understand the risks and consider all your options before making a decision.

Closure

Thus, we hope this article has provided valuable insights into Cash-Strapped? Tribal Loans: Friend or Foe?. We hope you find this article informative and beneficial. See you in our next article!