Tribal Lending Regulations: What You Need to Know

Tribal Lending Regulations: What You Need to Know

You’re looking for a loan, but traditional lenders are giving you the cold shoulder. You’re not alone. Millions of Americans turn to alternative lending options every year, and tribal lending has become increasingly popular. But hold on a sec! Before you jump headfirst into a tribal loan, let’s dive into the murky waters of tribal lending regulations.

What is Tribal Lending?

Related Articles: Tribal Lending Regulations: What You Need to Know

- Tribal Loans For People With BankruptcyTitle

- Tribal Loans: Your Guide To Repayment And Beyond

- Pawsitive Solutions: How Tribal Loans Can Help You Give Your Furry Friend The Care They Need

- Cash-Strapped? Tribal Loans: Your Quick Fix Or Financial Fiasco?

- Cashing In On Your Service: A Guide To Tribal Loans For Veterans

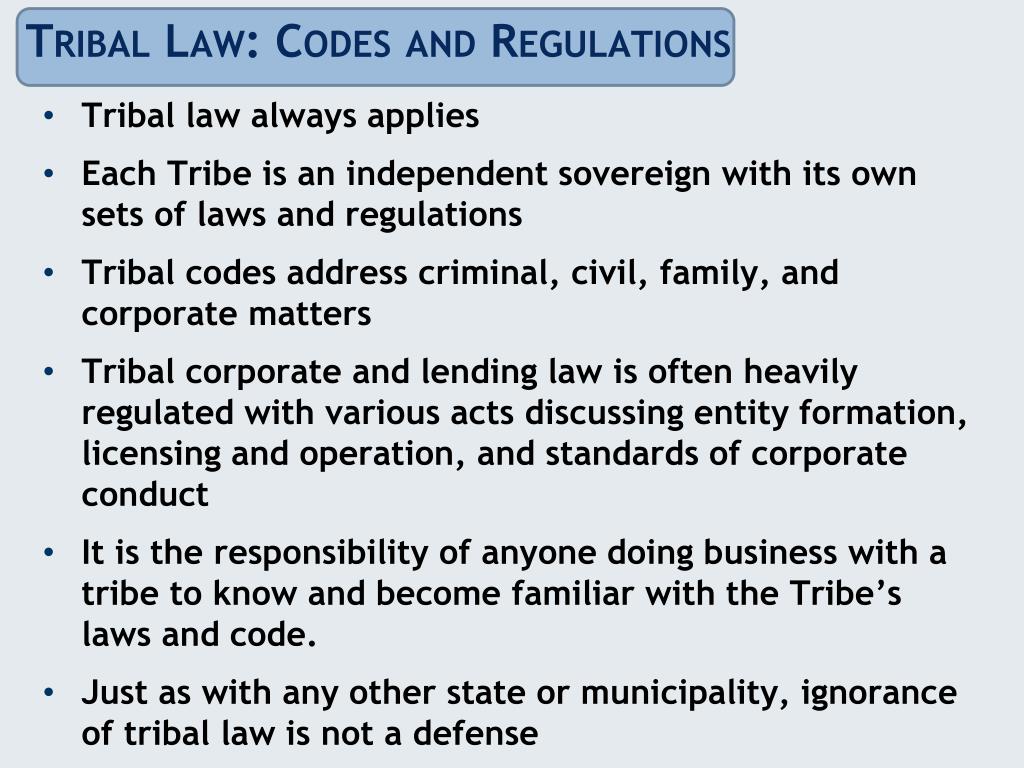

Tribal lending is a type of online lending where the lender is a Native American tribe or a company owned by a tribe. These tribes operate on sovereign land, which means they’re largely exempt from state laws, including those regulating lending.

Why Tribal Lending?

For some borrowers, tribal lending offers a lifeline when traditional lenders say "no." Here’s why:

- Lower Credit Score Requirements: Tribal lenders often have less stringent credit score requirements than traditional lenders, making them a tempting option for borrowers with less-than-perfect credit.

- Faster Approval Process: Tribal lenders often boast a quick and easy application process, with funds deposited in your account within a day or two.

- Higher Loan Amounts: Tribal loans can sometimes offer higher loan amounts compared to payday loans, making them a potentially attractive option for larger expenses.

The Catch: The Fine Print

While tribal lending may seem like a dream come true, it’s important to understand the potential downsides:

- Sky-High Interest Rates: Tribal loans often carry interest rates that are significantly higher than traditional loans. These rates can easily reach triple digits, making it incredibly difficult to repay the loan and causing borrowers to spiral into a cycle of debt.

- Lack of Transparency: The lack of clear regulations and oversight can lead to less transparency in tribal lending. This can make it difficult for borrowers to understand the true cost of their loan, including hidden fees and penalties.

- Aggressive Collection Practices: Some tribal lenders have been accused of using aggressive collection practices, including harassment and threats, to get borrowers to repay their loans.

Navigating the Legal Labyrinth

The legal landscape surrounding tribal lending is complex and ever-changing. Here’s a breakdown:

- State Laws vs. Tribal Sovereignty: The core conflict lies in the clash between state consumer protection laws and tribal sovereignty. States want to protect their citizens from predatory lending practices, while tribes argue that their sovereignty allows them to regulate their own affairs, including lending.

- The Consumer Financial Protection Bureau (CFPB): The CFPB has been actively involved in regulating tribal lending, issuing guidance and taking enforcement actions against lenders that violate consumer protection laws. However, the CFPB’s authority over tribal lenders is still being debated in court.

- The Indian Gaming Regulatory Act (IGRA): This federal law regulates gaming activities on tribal lands, but it doesn’t explicitly address lending. However, some argue that IGRA’s provisions regarding consumer protection could be applied to tribal lending.

The Bottom Line: Proceed with Caution

Tribal lending can be a risky proposition. While it may offer a quick solution for borrowers facing a financial crunch, the high interest rates, lack of transparency, and potential for aggressive collection practices can quickly turn a temporary fix into a long-term financial nightmare.

Here’s what you can do to protect yourself:

- Shop Around: Don’t settle for the first tribal loan offer you find. Compare rates, terms, and fees from multiple lenders.

- Read the Fine Print: Make sure you understand all the terms and conditions of the loan before you sign anything. Pay close attention to the interest rate, fees, repayment schedule, and collection practices.

- Consider Alternatives: Before you take out a tribal loan, explore other options like credit counseling, personal loans from friends or family, or even a traditional loan from a bank or credit union.

Tribal Lending: A Case Study

Let’s look at a real-life example: Imagine Sarah, a single mom struggling to make ends meet. She needs a quick $500 to cover unexpected car repairs. She finds a tribal lender online that offers a loan with a seemingly low interest rate. She signs the paperwork without carefully reading the fine print. A few months later, Sarah is drowning in debt. The high interest rate has ballooned her loan amount, and she’s facing aggressive collection calls. This is a common scenario in tribal lending, and it highlights the importance of doing your research and understanding the risks before you borrow.

FAQs About Tribal Lending

Q: Is tribal lending legal?

A: The legality of tribal lending is complex and varies by state. While tribes have the right to regulate their own affairs, including lending, many states have laws prohibiting predatory lending practices.

Q: Are tribal loans regulated?

A: Tribal lending is largely unregulated by state authorities, but the CFPB has taken steps to address consumer protection concerns. However, the CFPB’s authority over tribal lenders is still being challenged in court.

Q: What are the risks of tribal lending?

A: The risks of tribal lending include high interest rates, lack of transparency, aggressive collection practices, and potential legal issues.

Q: What are the alternatives to tribal lending?

A: Alternatives to tribal lending include credit counseling, personal loans from friends or family, traditional loans from banks or credit unions, and online peer-to-peer lending platforms.

Q: How can I protect myself from predatory lending practices?

A: To protect yourself from predatory lending practices, research lenders carefully, read the fine print, compare rates and terms, and consider alternatives.

Navigating the Uncertain Waters

The world of tribal lending is a complicated one, filled with legal gray areas and potential pitfalls. While tribal lending may offer a tempting solution for borrowers in need, it’s crucial to approach it with caution and a healthy dose of skepticism. Don’t let the promise of quick cash blind you to the potential risks. Do your research, understand the terms and conditions, and explore alternative options before you take the plunge. Your financial well-being depends on it.

Closure

Thus, we hope this article has provided valuable insights into Tribal Lending Regulations: What You Need to Know. We thank you for taking the time to read this article. See you in our next article!