Textbook Troubles? Tribal Loans Might Be Your Lifeline (But Read This First!)

Textbook Troubles? Tribal Loans Might Be Your Lifeline (But Read This First!)

Let’s face it, college is expensive. Between tuition, housing, and those pesky textbooks, it can feel like you’re drowning in a sea of bills. And those textbooks? They can be a real pain in the neck. You need them to succeed, but they can easily break the bank. So, what’s a cash-strapped student to do? Enter the world of tribal loans.

What are Tribal Loans, Anyway?

Related Articles: Textbook Troubles? Tribal Loans Might Be Your Lifeline (But Read This First!)

- Cash-Strapped? Tribal Lenders: Friend Or Foe?

- Stuck In A Credit Crunch? Tribal Loans Might Be Your Lifeline (But Read This First!)

- Stuck In A Bind? Easy Tribal Loans For Bad Credit Might Be Your Lifeline

- Stuck In A Financial Rut? Tribal Loans Might Be Your Lifeline (But Read This First!)

- Cash-Strapped? Tribal Lenders: Your Lifeline Or A Debt Trap?

Tribal loans are personal loans offered by lenders who are based on tribal land. These lenders are often able to operate outside of state regulations, which can mean higher interest rates and less consumer protection. But before you write them off as a bad idea, let’s dive a little deeper.

The Good, the Bad, and the Ugly of Tribal Loans

The Good:

- Quick Cash: Tribal loans are known for their speed. Need money fast? You could have cash in your account within a few days.

- No Credit Check: Many tribal lenders don’t require a perfect credit score. This is a big plus for students who might be just starting out with building their credit history.

- Flexible Terms: Some tribal lenders offer flexible repayment terms, which can be helpful if you’re not sure how much you can afford each month.

The Bad:

- High Interest Rates: This is the biggest drawback. Tribal loans often have sky-high interest rates, sometimes reaching triple digits. That means you’ll end up paying back way more than you borrowed.

- Limited Consumer Protection: Because tribal lenders often operate outside of state regulations, you might have fewer protections if something goes wrong.

- Debt Trap Potential: If you can’t keep up with the high payments, you could easily find yourself in a debt spiral that’s hard to climb out of.

The Ugly:

- Predatory Lending Practices: Some tribal lenders have been accused of using predatory lending practices, targeting vulnerable borrowers with high interest rates and hidden fees.

Is a Tribal Loan Right for You?

So, should you consider a tribal loan for textbooks? The answer is…it depends. Here’s a quick checklist to help you decide:

- Have you exhausted all other options? Before you even think about a tribal loan, explore every other possibility: scholarships, grants, student loans, work-study programs, and even selling your old textbooks.

- Can you afford the high interest rates? Do the math. Calculate the total cost of the loan, including interest, and make sure you can realistically afford the monthly payments without getting into financial trouble.

- Do you understand the terms and conditions? Read the fine print carefully. Make sure you understand the interest rate, fees, and repayment terms before you sign anything.

Alternatives to Tribal Loans

If you’re looking for a way to pay for textbooks without resorting to a tribal loan, here are some alternatives:

- Textbook Rental: This is a great way to save money, especially if you don’t need to keep the book after the semester is over. Many colleges and universities have their own rental programs, or you can find rental options online.

- Used Textbooks: Buying used textbooks is another way to save money. Check out online marketplaces like Amazon or eBay, or visit your campus bookstore.

- Textbook Sharing Programs: Some schools have student-run textbook sharing programs. Ask around and see if your school has one.

- Textbook Scholarships: Some scholarships are specifically designed to help students pay for textbooks. Do some research to see if you qualify for any.

A Word of Caution:

Remember, tribal loans are not a magic solution to your textbook woes. They can easily lead to a cycle of debt that’s hard to escape. If you’re struggling to afford textbooks, reach out to your school’s financial aid office or a reputable non-profit credit counseling agency. They can help you find affordable solutions and avoid falling into a debt trap.

FAQ: Tribal Loans for Textbooks

Q: What are the risks associated with tribal loans?

A: The biggest risk is the high interest rates. You could end up paying back significantly more than you borrowed. Additionally, tribal lenders often have limited consumer protection, which means you might have fewer options if something goes wrong.

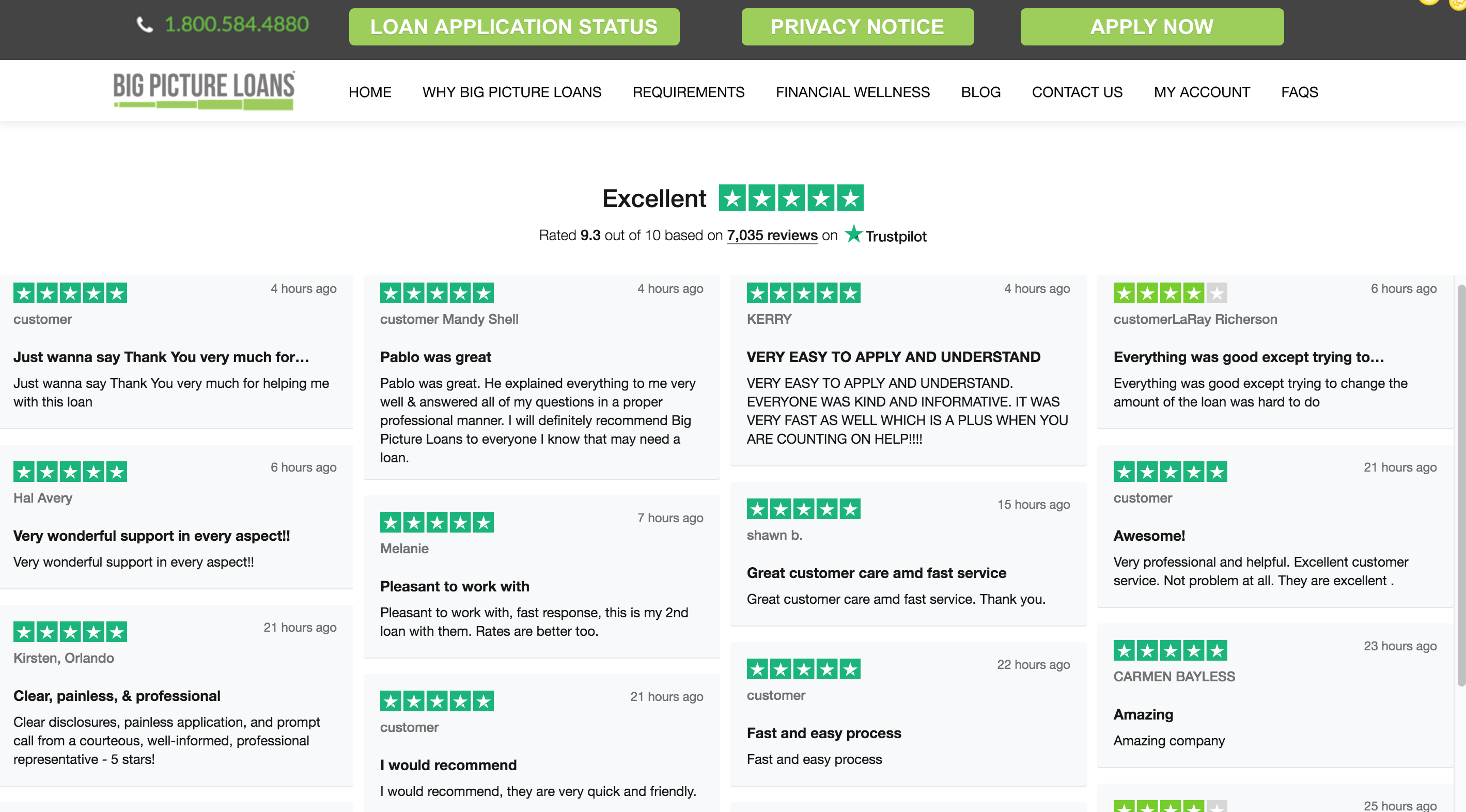

Q: How can I avoid getting scammed by a tribal lender?

A: Do your research. Look for lenders who are reputable and have a good track record. Read reviews from other borrowers. And be wary of lenders who offer "guaranteed approval" or who pressure you into making a decision quickly.

Q: What are some alternatives to tribal loans?

A: As mentioned earlier, there are many alternatives to tribal loans. Explore textbook rental programs, used textbooks, textbook sharing programs, and textbook scholarships. You can also reach out to your school’s financial aid office for assistance.

Q: What should I do if I’m already in debt from a tribal loan?

A: If you’re struggling to make payments, contact the lender immediately. Explain your situation and see if you can work out a payment plan. You can also reach out to a non-profit credit counseling agency for help.

Q: Are tribal loans legal?

A: Tribal loans are legal, but they are often subject to criticism due to their high interest rates and limited consumer protection. It’s important to understand the risks involved before taking out a tribal loan.

In Conclusion:

Tribal loans can be a tempting option when you’re facing a textbook crisis. But remember, they’re not a quick fix. The high interest rates and limited consumer protection can easily lead to a debt trap. Explore all your other options first. If you do decide to take out a tribal loan, make sure you understand the terms and conditions and that you can realistically afford the payments. And remember, there are resources available to help you find affordable solutions to your textbook woes. Don’t let the cost of education hold you back!

Closure

Thus, we hope this article has provided valuable insights into Textbook Troubles? Tribal Loans Might Be Your Lifeline (But Read This First!). We thank you for taking the time to read this article. See you in our next article!