Stuck in a Debt Spiral? Tribal Loans: Friend or Foe?

Stuck in a Debt Spiral? Tribal Loans: Friend or Foe?

You’re drowning in high-interest debt. Credit card bills are piling up, payday loans are sucking the life out of your paycheck, and you’re starting to feel like you’re just spinning your wheels. You’ve tried everything – budgeting, cutting back, maybe even a debt consolidation loan – but nothing seems to work. You’re desperate for a solution, and you’ve heard whispers of something called "tribal loans."

But are tribal loans a lifeline or a trap? Let’s dive into the world of tribal lending and see if it can actually help you climb out of your debt hole.

Related Articles: Stuck in a Debt Spiral? Tribal Loans: Friend or Foe?

- Guaranteed Loans For Bad Credit? Don’t Get Your Hopes Up!

- Cash-Strapped? Tribal Lenders: Friend Or Foe?

- Cash-Strapped? Tribal Loans: A Lifeline Or A Trap?

- Stuck In A Credit Crunch? Tribal Loans Might Be Your Lifeline

- Stuck In Debt? Tribal Loans Might Be Your Lifeline (But Read This First!)

What are Tribal Loans, Anyway?

Tribal loans are short-term, high-interest loans offered by lenders who are affiliated with Native American tribes. These lenders claim to operate on sovereign tribal land, which means they’re not subject to the same state regulations that govern traditional lenders.

Think of it like this: Imagine a small town in the middle of nowhere, where the local sheriff doesn’t have much power. Tribal lenders are like businesses in that town – they can set their own rules, even if those rules are different from the rest of the country.

Why are Tribal Loans So Popular?

Tribal loans have gained popularity because they often seem like a quick fix for people with bad credit or who need money fast. Here’s why:

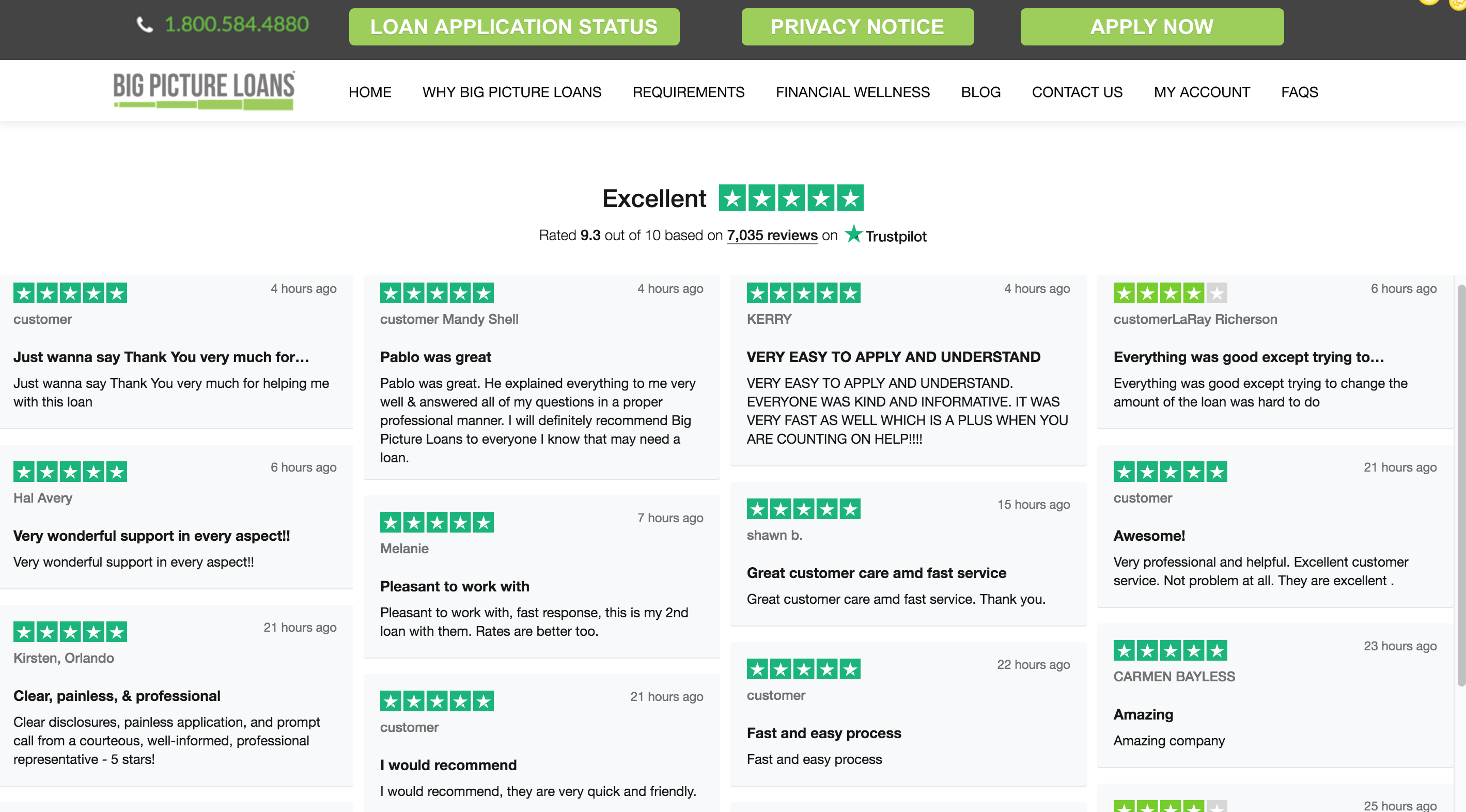

- Easy Approval: Tribal lenders typically have looser lending requirements than traditional banks or credit unions. This makes them attractive to people who have been turned down for other loans.

- Fast Funding: You can often get the money you need within a few days, sometimes even hours. This is perfect for those who need cash in a hurry.

- No Credit Check (Sometimes): While some tribal lenders do check your credit, others don’t. This is a big draw for people with bad credit or no credit history.

The Dark Side of Tribal Loans

But before you jump at the chance of a tribal loan, it’s crucial to understand the potential downsides:

- Sky-High Interest Rates: Tribal loans are notorious for their sky-high interest rates, often exceeding 300% APR. This means you’ll end up paying back significantly more than you borrowed, making it very difficult to get out of debt.

- Hidden Fees: In addition to high interest rates, tribal lenders often charge hefty fees for things like origination, processing, and late payments. These fees can quickly add up, making the loan even more expensive.

- Aggressive Collection Practices: If you fall behind on payments, tribal lenders can be very aggressive in their collection efforts. They may use tactics like harassing phone calls, threatening legal action, and even reporting your debt to credit bureaus, which can damage your credit score further.

- Lack of Regulation: Because tribal lenders operate on sovereign land, they are often not subject to the same regulations as traditional lenders. This means they can sometimes operate with little oversight, making it easier for them to take advantage of borrowers.

The "Tribal Loan" Trap

Many people fall into the "tribal loan" trap because they’re desperate for cash and don’t fully understand the risks. They may see the easy approval and fast funding as a solution, but they don’t realize the true cost of the loan.

Think of it like this: You’re stranded in the desert, thirsty and desperate for water. Someone offers you a bottle of water, but it’s laced with poison. The immediate relief of the water is tempting, but it will ultimately kill you. Tribal loans can be like that poisoned water – they offer temporary relief, but they can lead to long-term financial ruin.

Alternatives to Tribal Loans

So what are your options if you need money but don’t want to get caught in the tribal loan trap?

- Credit Union Loans: Credit unions are often more forgiving with credit scores than banks. They may also offer lower interest rates and more flexible terms.

- Personal Loans: Online lenders offer personal loans with competitive interest rates and quick approval times. Be sure to shop around and compare rates before you choose a lender.

- Debt Consolidation Loans: A debt consolidation loan can help you combine multiple high-interest debts into one loan with a lower interest rate. This can make it easier to manage your debt and save money on interest.

- Community Resources: Many communities offer free financial counseling and resources to help people struggling with debt. These resources can provide guidance on budgeting, debt management, and other financial issues.

The Bottom Line: Avoid Tribal Loans

While tribal loans might seem like a quick fix, they are often a dangerous trap. The high interest rates, hidden fees, and aggressive collection practices can quickly spiral you into deeper debt.

If you’re struggling with debt, there are better alternatives out there. Explore the options listed above and seek help from a financial counselor. It might take a little more effort, but it’s worth it in the long run to avoid the predatory practices of tribal lenders.

FAQ: Tribal Loans for People with High-Interest Debt

Q: What is the average interest rate for tribal loans?

A: The average interest rate for tribal loans can vary, but it’s often very high, exceeding 300% APR.

Q: Are tribal loans legal?

A: Tribal loans are legal, but they are often subject to scrutiny and legal challenges.

Q: How can I avoid tribal loan scams?

A: Be wary of lenders who promise easy approval, no credit checks, or very fast funding. Research the lender thoroughly and read all the terms and conditions before you agree to a loan.

Q: What should I do if I’m already in a tribal loan?

A: If you’re already in a tribal loan, try to negotiate a lower interest rate or payment plan with the lender. If that doesn’t work, consider seeking help from a credit counselor or debt consolidation agency.

Q: Is it better to take a tribal loan than to default on other debts?

A: Defaulting on other debts can have serious consequences, including damage to your credit score and potential legal action. However, taking a tribal loan with its high interest rates and fees will likely make your debt situation worse.

The key takeaway: Tribal loans can be a dangerous trap for people struggling with high-interest debt. Explore other options and seek help from reputable financial resources before you consider taking out a tribal loan. Your future financial well-being depends on it.

Closure

Thus, we hope this article has provided valuable insights into Stuck in a Debt Spiral? Tribal Loans: Friend or Foe?. We thank you for taking the time to read this article. See you in our next article!