Stuck in a Credit Hole? Indian Loans for Bad Credit Can Help You Dig Out!

Stuck in a Credit Hole? Indian Loans for Bad Credit Can Help You Dig Out!

Let’s face it, life throws curveballs. Sometimes those curveballs land right in your credit score, leaving you feeling like you’re stuck in a financial quicksand. You’ve got bills piling up, but traditional lenders are giving you the cold shoulder. Sound familiar? Don’t despair! There’s a light at the end of the tunnel, and it’s called Indian loans for bad credit.

What are Indian Loans?

Related Articles: Stuck in a Credit Hole? Indian Loans for Bad Credit Can Help You Dig Out!

- Cash-Strapped? Direct Tribal Lenders: Your Lifeline Or A Trap?

- Tired Of Loan Rejections? Get Guaranteed Approval Near You!

- Cash-Strapped? Tribal Loans Might Be Your Lifeline (But Read This First!)

- Stuck In A Credit Crunch? Tribal Loans Might Be Your Lifeline (But Read This First!)

- Stuck In A Credit Crunch? Tribal Loans Might Be Your Lifeline

Indian loans, also known as tribal loans, are a type of short-term loan offered by lenders based on tribal land. These lenders operate outside of traditional state regulations, allowing them to offer loans to borrowers with less-than-perfect credit. Think of them as a lifeline for those who’ve been hit hard by financial setbacks.

Why Choose Indian Loans for Bad Credit?

So, why are these loans a good option for those struggling with bad credit? Let’s break it down:

- Easier Approval: One of the biggest perks is that Indian loans are typically easier to qualify for than traditional loans. Lenders are less concerned about your credit history and focus more on your ability to repay the loan.

- Faster Funding: Need money fast? Indian loans can often get you the funds you need within a matter of days, sometimes even hours! This speed can be a lifesaver when you’re facing a financial emergency.

- Flexible Loan Amounts: Indian loans are available in a range of amounts, so you can borrow what you need without having to take out a larger loan than you can handle.

- No Collateral Required: Unlike some traditional loans, Indian loans generally don’t require collateral. This means you can get the money you need without putting your assets at risk.

/cloudfront-us-east-1.images.arcpublishing.com/dmn/VQTVMZKYXBBLVECIAWNZC46WME.jpg)

The Fine Print: What You Need to Know

While Indian loans offer a great solution for those with bad credit, it’s important to understand the potential downsides:

- Higher Interest Rates: Because these loans are geared towards borrowers with lower credit scores, they often come with higher interest rates than traditional loans.

- Short Repayment Terms: Indian loans are generally short-term loans, meaning you’ll need to repay them quickly. This can put pressure on your finances if you’re not careful.

- Potential for Debt Traps: If you’re not careful, you could end up in a cycle of debt with Indian loans. If you can’t repay the loan on time, you may be charged hefty fees and penalties, potentially leading to more debt.

How to Choose the Right Indian Loan for You

Choosing the right Indian loan can make all the difference. Here are some tips:

- Shop Around: Don’t settle for the first lender you find. Compare interest rates, fees, and repayment terms from multiple lenders to find the best deal.

- Read the Fine Print: Before signing anything, take the time to read the loan agreement carefully. Make sure you understand all the terms and conditions, including interest rates, fees, and repayment terms.

- Consider Your Budget: Be realistic about how much you can afford to repay each month. Don’t take out a loan that will put you in a financial bind.

FAQ: Indian Loans for Bad Credit

Q: What is the minimum credit score required for an Indian loan?

A: There’s no set minimum credit score requirement for Indian loans. Lenders focus more on your ability to repay the loan than your credit history.

Q: How much can I borrow with an Indian loan?

A: Loan amounts vary depending on the lender and your individual circumstances. You can typically borrow between a few hundred dollars and a few thousand dollars.

Q: What are the typical interest rates for Indian loans?

A: Interest rates for Indian loans can be high, often ranging from 100% to 600% APR (Annual Percentage Rate). It’s crucial to compare rates from multiple lenders to find the best deal.

Q: What are the fees associated with Indian loans?

A: Indian loans often come with various fees, including origination fees, late payment fees, and default fees. Make sure you understand all the fees before you take out a loan.

Q: Are Indian loans safe?

A: Like any loan, Indian loans can be risky if you’re not careful. Choose a reputable lender, read the fine print, and understand the terms and conditions before you borrow.

Q: What happens if I can’t repay my Indian loan?

A: If you can’t repay your loan on time, you may be charged hefty fees and penalties. In some cases, the lender may take legal action to collect the debt.

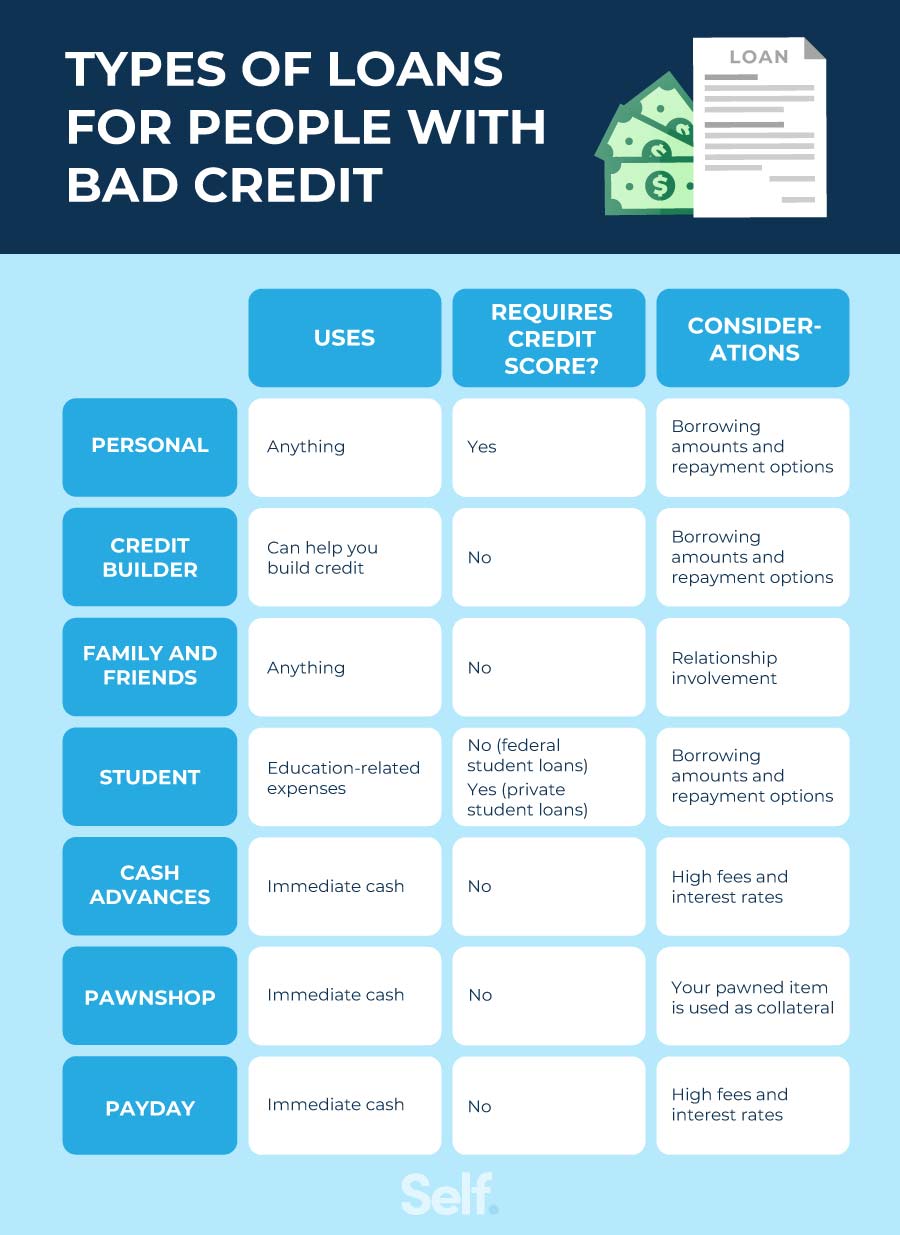

Q: What are some alternatives to Indian loans?

A: If you’re struggling with bad credit, there are other options available, such as:

- Credit Union Loans: Credit unions often offer loans with lower interest rates than traditional banks.

- Peer-to-Peer Lending: Peer-to-peer lending platforms allow you to borrow money from individuals.

- Secured Loans: Secured loans require collateral, but they often come with lower interest rates.

- Credit Counseling: A credit counselor can help you develop a budget and manage your debt.

The Bottom Line

Indian loans can be a lifesaver for those with bad credit, but they’re not a magic bullet. It’s crucial to understand the risks and potential downsides before you borrow. Shop around, read the fine print, and choose a lender you trust. With careful planning and responsible borrowing, you can use Indian loans to get back on your feet and start building a brighter financial future.

Closure

Thus, we hope this article has provided valuable insights into Stuck in a Credit Hole? Indian Loans for Bad Credit Can Help You Dig Out!. We hope you find this article informative and beneficial. See you in our next article!