Guaranteed Loan Approval? Don’t Get Scammed!

Guaranteed Loan Approval? Don’t Get Scammed!

Let’s face it, sometimes life throws you a curveball. Maybe your car’s on its last legs, your roof’s leaking like a sieve, or you just need a little extra cash to make ends meet. Whatever the reason, you’re thinking about a loan. But you’re also thinking, "Is there any way to get guaranteed loan approval?"

Well, the truth is, there’s no such thing as a guaranteed loan approval. It’s like trying to find a unicorn in your backyard – it just doesn’t exist. Anyone promising you guaranteed approval is likely trying to pull a fast one.

Related Articles: Guaranteed Loan Approval? Don’t Get Scammed!

- Stuck In A Bind? Easy Tribal Loans For Bad Credit Might Be Your Lifeline

- Stuck In A Bind? Tribal Installment Loans: Your Financial Lifeline?

- Cash-Strapped? Tribal Loans Might Be Your Lifeline (But Read This First!)

- Cash-Strapped On The Rez? No Credit Check Loans Might Be Your Lifeline

- Stuck In A Credit Crunch? Tribal Loans Might Be Your Lifeline (But Read This First!)

The Hard Truth About Loan Approval

Lenders are businesses, and businesses want to make money. They’re not in the business of handing out free cash. They need to be confident you can repay the loan before they’ll approve it. This means they’ll look at your credit score, income, debt-to-income ratio, and other factors to assess your risk.

So, while you can’t guarantee approval, you can certainly increase your chances. Think of it like prepping for a job interview – you wouldn’t show up in sweatpants and flip-flops, would you?

How to Boost Your Loan Approval Odds

Here’s the deal: getting a loan isn’t about luck, it’s about preparation. Think of it like building a strong foundation for your application. Here’s how to do it:

1. Clean Up Your Credit

Your credit score is like your financial resume. Lenders are going to scrutinize it, so make sure it’s in tip-top shape.

- Check Your Credit Report: Get a free copy of your credit report from all three credit bureaus (Experian, Equifax, and TransUnion) at AnnualCreditReport.com. Look for any errors and dispute them immediately.

- Pay Your Bills On Time: Late payments are a major credit score killer. Set reminders, use autopay, or whatever it takes to stay on top of your bills.

- Lower Your Credit Utilization: This is the amount of credit you’re using compared to your available credit limit. Aim to keep it below 30%.

- Don’t Open New Accounts: Opening too many new accounts can negatively impact your score. Stick with the accounts you already have and use them responsibly.

2. Boost Your Income

Lenders want to see a steady stream of income to feel confident you can handle the monthly loan payments.

- Negotiate a Raise: If you’re feeling confident in your work, don’t be afraid to ask for a raise. Even a small increase can make a big difference.

- Take on a Side Hustle: There are tons of ways to make extra cash these days. From driving for a ride-sharing service to selling crafts online, find something that fits your skills and interests.

- Cut Down on Expenses: Take a hard look at your budget and see where you can cut back. Even small changes can add up over time.

3. Manage Your Debt

Too much debt can be a red flag for lenders. If you’re drowning in debt, it’s time to get your finances in order.

- Consolidate Your Debt: Combining multiple loans into one with a lower interest rate can save you money and make your payments more manageable.

- Pay Down High-Interest Debt: Focus on paying down debt with the highest interest rates first. This will save you money in the long run.

- Create a Budget: A budget can help you track your spending and identify areas where you can cut back. There are tons of free budgeting apps and websites available.

4. Shop Around for the Best Rates

Don’t just settle for the first loan offer you get. Shop around and compare rates from multiple lenders.

- Use a Loan Comparison Website: Websites like Bankrate and LendingTree can help you compare loan offers from different lenders.

- Check With Local Credit Unions: Credit unions often offer lower interest rates than banks.

- Consider Online Lenders: Online lenders are becoming increasingly popular and can offer competitive rates.

5. Prepare Your Documents

Before you apply for a loan, gather all the necessary documents. This will make the application process smoother and faster.

- Proof of Income: This could include pay stubs, tax returns, or bank statements.

- Proof of Residence: This could include a utility bill or lease agreement.

- Photo ID: This could be your driver’s license or passport.

- Credit Report: It’s a good idea to get a copy of your credit report before you apply for a loan.

6. Be Honest and Transparent

Lenders can tell when you’re trying to hide something. Be honest about your financial situation and don’t try to embellish your income or downplay your debt.

7. Don’t Get Scammed!

As mentioned before, there’s no such thing as guaranteed loan approval. Be wary of any lender that promises you this. If something seems too good to be true, it probably is.

Red Flags to Watch Out For:

- High-Pressure Sales Tactics: If a lender is pressuring you to sign a loan agreement immediately, that’s a red flag. Take your time and read the fine print carefully.

- Upfront Fees: Legitimate lenders don’t charge upfront fees for loan applications. If a lender asks for money before you’ve even been approved, it’s a scam.

- Guaranteed Approval: As we’ve already discussed, there’s no such thing as guaranteed loan approval. Any lender promising this is likely trying to take advantage of you.

- Too-Good-to-Be-True Interest Rates: If a lender is offering an interest rate that seems unbelievably low, it’s probably a scam. Legitimate lenders have to make money, and they won’t offer rates that are too low to be sustainable.

8. Consider Alternatives

If you’re struggling to get approved for a loan, there are other options available.

- Personal Loan from Family or Friends: If you have a close relationship with someone who can lend you money, this could be a good option. Just make sure to put everything in writing to avoid any misunderstandings.

- Credit Builder Loan: These loans can help you build your credit score by making small, regular payments.

- Secured Loan: A secured loan is backed by collateral, such as a car or home. This can make it easier to get approved for a loan, but you risk losing your collateral if you default on the loan.

- Debt Consolidation: If you have multiple debts with high interest rates, debt consolidation can help you save money and make your payments more manageable.

The Bottom Line

Getting a loan isn’t always easy, but it’s definitely possible. By taking the time to prepare, shop around, and be honest with yourself and lenders, you can increase your chances of getting approved. And remember, there’s no such thing as guaranteed loan approval. Don’t fall for scams and always do your research before signing any loan agreement.

FAQ: Guaranteed Loan Approval

Q: What are some common loan scams?

A: Loan scams can take many forms, but some common ones include:

- Guaranteed Loan Approval Scams: These scams prey on people who are desperate for a loan. They promise guaranteed approval, but then require you to pay upfront fees or provide personal information.

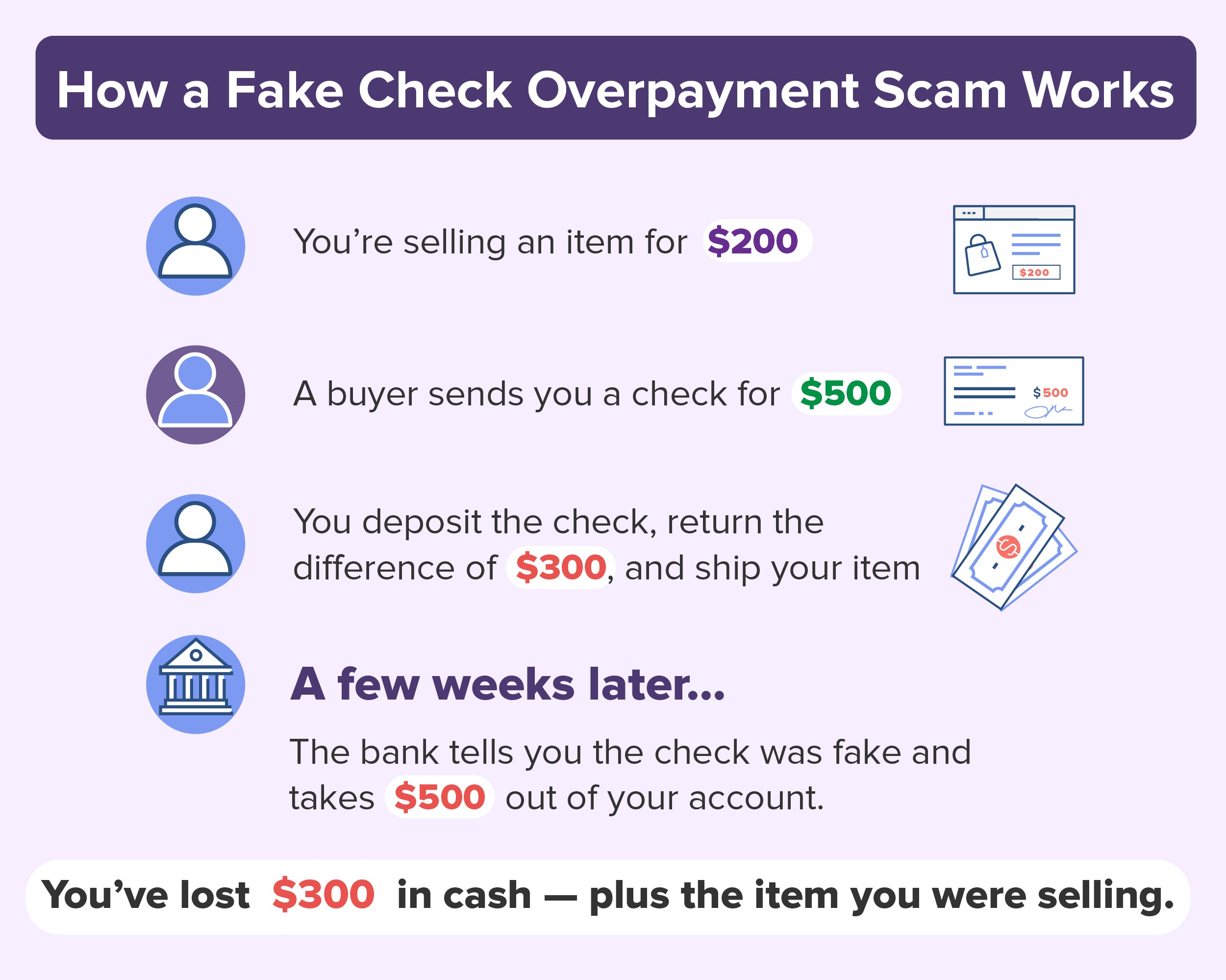

- Advance Fee Loans: These scams require you to pay a fee upfront before you receive the loan. The scammer then disappears with your money, and you never get the loan.

- Phishing Scams: These scams involve emails or text messages that appear to be from a legitimate lender. They ask you to click on a link or provide personal information, which is then used to steal your identity.

Q: What are the signs of a loan scam?

A: Here are some red flags to watch out for:

- Guaranteed Loan Approval: There’s no such thing as guaranteed loan approval. Any lender promising this is likely trying to scam you.

- Upfront Fees: Legitimate lenders don’t charge upfront fees for loan applications. If a lender asks for money before you’ve even been approved, it’s a scam.

- High-Pressure Sales Tactics: If a lender is pressuring you to sign a loan agreement immediately, that’s a red flag. Take your time and read the fine print carefully.

- Too-Good-to-Be-True Interest Rates: If a lender is offering an interest rate that seems unbelievably low, it’s probably a scam. Legitimate lenders have to make money, and they won’t offer rates that are too low to be sustainable.

- Lack of Transparency: If a lender is unwilling to answer your questions or provide you with information about the loan terms, it’s a red flag.

Q: What should I do if I think I’ve been scammed?

A: If you think you’ve been scammed, it’s important to take action immediately.

- Report the Scam: Contact the Federal Trade Commission (FTC) and your local police department.

- Change Your Passwords: If you provided your personal information to the scammer, change your passwords for all of your online accounts.

- Monitor Your Credit Reports: Check your credit reports regularly for any suspicious activity.

- Contact Your Bank: If you gave the scammer your bank account information, contact your bank immediately to report the fraud.

Q: How can I protect myself from loan scams?

A: Here are some tips for protecting yourself from loan scams:

- Do Your Research: Before you apply for a loan, research the lender and read reviews from other borrowers.

- Be Wary of Guaranteed Loan Approval: There’s no such thing as guaranteed loan approval. Any lender promising this is likely trying to scam you.

- Don’t Pay Upfront Fees: Legitimate lenders don’t charge upfront fees for loan applications.

- Read the Fine Print: Before you sign any loan agreement, read the fine print carefully. Make sure you understand all of the terms and conditions.

- Trust Your Gut: If something seems too good to be true, it probably is. If you have any doubts about a lender, don’t do business with them.

Remember, getting a loan can be a stressful process, but it doesn’t have to be a nightmare. By following these tips and being smart about your choices, you can increase your chances of getting approved and avoid getting scammed.

Closure

Thus, we hope this article has provided valuable insights into Guaranteed Loan Approval? Don’t Get Scammed!. We appreciate your attention to our article. See you in our next article!