Cash-Strapped? Tribal Loans: Friend or Foe?

Cash-Strapped? Tribal Loans: Friend or Foe?

You’re in a bind. Bills are piling up, and your paycheck feels like a distant memory. You’ve heard about tribal loans, but are they the answer to your prayers, or a recipe for disaster? Let’s dive into the world of tribal lending and see if it’s right for you.

What are Tribal Loans?

Related Articles: Cash-Strapped? Tribal Loans: Friend or Foe?

- Stuck In A Credit Score Rut? Native American Lenders Might Be Your Ticket Out!

- Cash-Strapped? Here’s Your Guide To Direct Tribal Lenders

- The Rise Of The New Tribal Lenders: Friend Or Foe?

- Stuck In A Credit Crunch? Tribal Loans Might Be Your Lifeline (But Read This First!)

- Cash-Strapped? Tribal Loans Might Be Your Lifeline (But Read This First!)

In a nutshell, tribal loans are short-term, high-interest loans offered by lenders that are based on or affiliated with Native American tribes. These lenders often operate online and target individuals with poor credit who may struggle to get traditional loans from banks or credit unions.

The Appeal of Tribal Loans:

- Easy Access: Tribal lenders often have less stringent requirements than traditional financial institutions. You might be approved even with a low credit score.

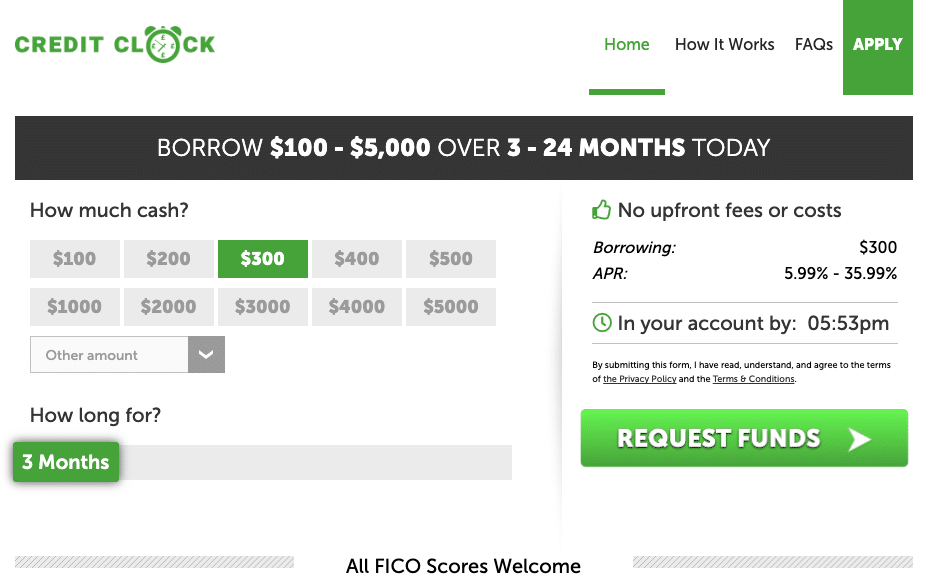

- Fast Funding: Money can be deposited into your account within hours or even minutes.

- No Credit Check (Sometimes): Some tribal lenders don’t perform hard credit checks, which can be a boon for those with poor credit.

The Dark Side of Tribal Loans:

While the ease of access and quick funding might seem appealing, tribal loans come with a hefty price tag. Here’s why you need to proceed with caution:

- Sky-High Interest Rates: Prepare to pay interest rates that can reach triple digits! That’s right, APRs can soar well above 300%.

- Hidden Fees: Don’t be fooled by low advertised rates. Tribal loans often come with a slew of hidden fees, like origination fees, late payment fees, and even fees for simply accessing your account.

- Aggressive Collection Practices: When you fall behind on payments, tribal lenders can be relentless in their pursuit of your money. They may use aggressive tactics like constant phone calls, emails, and even threats of legal action.

- Debt Cycle Trap: The high interest rates and hidden fees can quickly snowball into a debt spiral. It can be incredibly difficult to pay back the loan, and you may end up owing more than you borrowed.

Who Regulates Tribal Loans?

This is where things get tricky. Tribal lenders often claim to be exempt from state regulations. They operate under the sovereignty of Native American tribes, which can make it difficult for state authorities to intervene. This can leave borrowers with little protection if they fall victim to predatory lending practices.

Alternatives to Tribal Loans:

Before you even think about taking out a tribal loan, consider these alternatives:

- Credit Union Loans: Credit unions often offer lower interest rates and more flexible terms than traditional banks. They also tend to be more understanding of financial hardships.

- Personal Loans: Online lenders and banks offer personal loans with competitive interest rates, especially if you have good credit.

- Payday Loans: Payday loans are short-term, high-interest loans that can provide temporary relief. However, they’re notorious for their high fees and can easily lead to a debt trap. Use them sparingly and only as a last resort.

- Community Resources: Many local organizations offer free financial counseling and assistance. They can help you create a budget, find ways to reduce your expenses, and explore other options for getting out of debt.

How to Avoid Tribal Loan Scams:

- Be wary of online advertisements: If a loan offer seems too good to be true, it probably is. Don’t be swayed by flashy websites or promises of quick cash.

- Research the lender: Check the lender’s reputation with the Better Business Bureau and online review sites. Read customer testimonials and look for red flags.

- Read the fine print: Don’t just skim the loan agreement. Pay close attention to the interest rates, fees, and repayment terms. Ask questions if anything is unclear.

- Don’t be pressured: A reputable lender won’t pressure you into taking out a loan. If you feel uncomfortable or pressured, walk away.

The Bottom Line:

Tribal loans can seem like a quick fix for financial woes, but they often come with hidden costs and predatory practices. It’s crucial to weigh the risks and consider alternative options before taking out a tribal loan. If you’re facing financial hardship, seek help from a credit counselor or other community resources. Remember, borrowing money should be a responsible decision, not a desperate measure.

FAQ About Tribal Loans:

Q: Are tribal loans legal?

A: Yes, tribal loans are generally legal. However, they are often subject to controversy due to their high interest rates and questionable lending practices.

Q: Who regulates tribal loans?

A: Tribal loans are typically regulated by the tribes themselves, which can make it difficult for state authorities to intervene.

Q: What are the risks of taking out a tribal loan?

A: The risks of tribal loans include high interest rates, hidden fees, aggressive collection practices, and the potential for a debt spiral.

Q: How can I avoid tribal loan scams?

A: Be wary of online advertisements, research the lender, read the fine print carefully, and don’t be pressured into taking out a loan.

Q: What are some alternatives to tribal loans?

A: Alternatives to tribal loans include credit union loans, personal loans, payday loans (used sparingly), and community resources.

Q: What should I do if I’m already in debt from a tribal loan?

A: If you’re struggling to repay a tribal loan, contact a credit counselor or other financial expert for help. They can provide guidance on debt management and explore options for debt consolidation or repayment plans.

Remember, taking out a loan should be a well-informed decision. Don’t let desperation lead you into a financial trap. Explore all your options and choose the best path for your individual circumstances.

Closure

Thus, we hope this article has provided valuable insights into Cash-Strapped? Tribal Loans: Friend or Foe?. We hope you find this article informative and beneficial. See you in our next article!