Cash-Strapped? Tribal Loans: Friend or Foe?

Cash-Strapped? Tribal Loans: Friend or Foe?

You’re in a bind. Bills are piling up, and your bank account’s lookin’ like a desert. You need cash, and fast. A friend suggests a "tribal loan." Sounds like a lifeline, right? But hold on, partner. Let’s dive into the world of tribal loans, separate fact from fiction, and figure out if they’re the answer to your prayers or a recipe for financial disaster.

The Tribal Loan Landscape: Navigating the Unfamiliar

Related Articles: Cash-Strapped? Tribal Loans: Friend or Foe?

- Stuck In A Credit Crunch? Tribal Lending Might Be Your Lifeline (But Read This First!)

- Stuck In A Credit Crunch? Tribal Loans Might Be Your Lifeline (But Read This First!)

- Stuck In A Credit Crunch? Tribal Loans Might Be Your Lifeline (But Read This First!)

- Stuck In A Bind? Tribal Installment Loans: Your Financial Lifeline?

- Cash-Strapped? Tribal Loans Might Be Your Lifeline (But Read This First!)

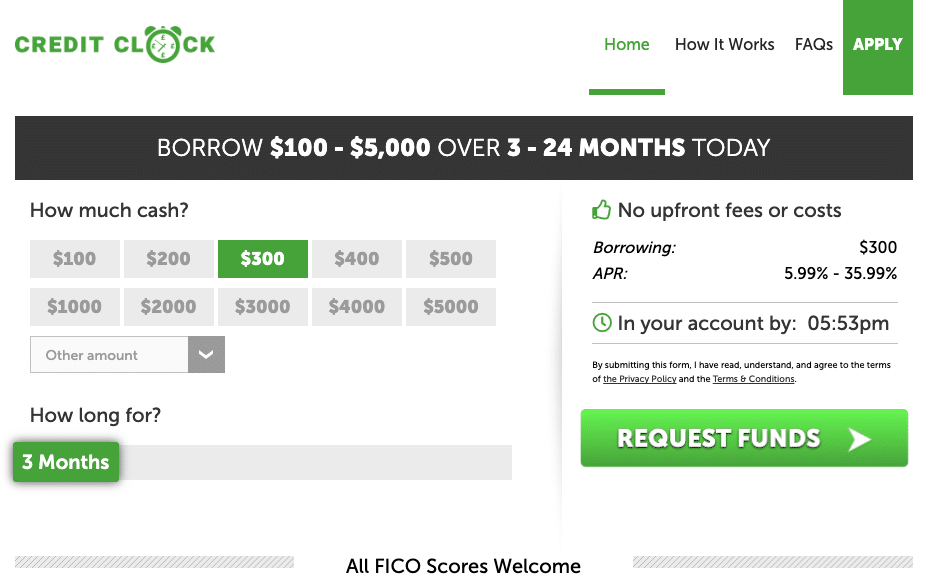

Tribal loans are a type of short-term, high-interest loan offered by lenders affiliated with Native American tribes. These lenders often operate online and can seem like a convenient solution when you’re in a tight spot. But before you jump in headfirst, it’s crucial to understand the ins and outs of these loans.

The Tribal Connection: A Legal Loophole?

The key to understanding tribal loans is the legal framework they operate under. Because Native American tribes have sovereignty, they can sometimes operate outside of state regulations that govern traditional lenders. This means they might be able to charge higher interest rates than state law would typically allow.

The "Catch" of Tribal Loans

So, what’s the deal with these high interest rates? Well, they’re a double-edged sword. On the one hand, they can seem tempting when you’re desperate for cash. On the other hand, they can quickly spiral into a debt nightmare if you’re not careful.

The High Cost of Convenience: APR’s That Bite

Tribal loans often come with Annual Percentage Rates (APRs) that can easily reach triple digits. This means the interest you accrue can quickly dwarf the amount you borrowed. Think about it: Borrowing $500 could easily turn into a $1000 debt within a few months if you’re not able to repay it quickly.

The Repayment Rollercoaster: A Potential Trap

Tribal loans are designed to be repaid in short periods, usually within weeks or months. If you’re unable to repay the loan on time, you could face additional fees and charges, further increasing your debt burden. This can lead to a vicious cycle of borrowing and repaying, making it difficult to climb out of financial hardship.

The "Tribal" Connection: A Question of Ethics

The use of tribal sovereignty to circumvent state lending regulations has raised ethical concerns. Some argue that these loans prey on vulnerable borrowers who are desperate for quick cash and don’t fully understand the risks involved. Others defend the practice, arguing that it provides a financial lifeline to communities that might otherwise lack access to traditional lending options.

Alternatives to Tribal Loans: Exploring Safer Options

Before you jump into the tribal loan pool, consider these alternatives:

- Credit Unions: Credit unions are often more lenient with borrowers than traditional banks and offer lower interest rates on loans.

- Personal Loans: Personal loans from online lenders can provide a more affordable option than tribal loans, although they may require a credit check.

- Payday Alternatives: Many states have programs that offer payday loan alternatives, such as small-dollar loans with lower interest rates and longer repayment terms.

- Family and Friends: If you’re in a tight spot, consider reaching out to family or friends for a loan. This can be a good option if you’re comfortable disclosing your financial situation and can repay the loan on a reasonable schedule.

The Bottom Line: Proceed with Caution

Tribal loans can be a tempting solution when you’re in a pinch, but they often come with high costs and potential pitfalls. Before you consider a tribal loan, explore all your options and weigh the risks and benefits carefully. If you’re struggling with debt, reach out to a credit counselor or financial advisor for help. They can provide guidance and support as you work towards a brighter financial future.

FAQ About Tribal Loans

Q: Are tribal loans legal?

A: Tribal loans are generally legal, but they are often subject to different regulations than traditional loans. It’s important to research the specific laws in your state.

Q: Why do tribal loans have such high interest rates?

A: Tribal loans often have high interest rates because they are short-term loans with limited repayment periods. They also may operate outside of state regulations that limit interest rates.

Q: Are tribal loans safe?

A: Tribal loans can be risky. If you’re unable to repay the loan on time, you could face additional fees and charges, which can quickly spiral into a debt trap.

Q: What should I do if I’m struggling with tribal loan debt?

A: If you’re struggling with tribal loan debt, contact a credit counselor or financial advisor for help. They can provide guidance and support as you work towards a brighter financial future.

Q: How can I avoid tribal loans in the future?

A: Here are some tips:

- Build a strong credit history: This will make you more eligible for traditional loans with lower interest rates.

- Create a budget and stick to it: This will help you avoid overspending and needing to take out high-interest loans.

- Set aside an emergency fund: This will give you a safety net if you encounter unexpected expenses.

- Consider a secured loan: If you need a loan but have poor credit, a secured loan may be a better option. These loans require collateral, which reduces the risk for the lender and can result in a lower interest rate.

The Road to Financial Freedom: A Journey, Not a Sprint

Getting out of debt and achieving financial stability takes time and effort. But it’s possible, especially if you’re proactive and seek help when you need it. Don’t let financial hardship lead you down a path of high-interest loans and potential debt traps. Make informed decisions, explore all your options, and take control of your financial future.

Closure

Thus, we hope this article has provided valuable insights into Cash-Strapped? Tribal Loans: Friend or Foe?. We appreciate your attention to our article. See you in our next article!