Cash-Strapped? The Rise of Tribal Payday Lenders and What You Need to Know

Cash-Strapped? The Rise of Tribal Payday Lenders and What You Need to Know

Let’s face it, life throws curveballs. Unexpected car repairs, medical bills, or even just a tight budget can leave you scrambling for cash. And when you’re in a bind, payday loans might seem like a quick fix. But before you rush into a loan, you need to understand the ins and outs of a specific type of lender: tribal payday lenders.

These lenders, often operating online, are gaining traction, but they’re also shrouded in controversy. So, what’s the deal with tribal payday lenders? Are they a lifeline or a risky gamble? Let’s dive in.

Related Articles: Cash-Strapped? The Rise of Tribal Payday Lenders and What You Need to Know

- Cash-Strapped? Tribal Lenders: Friend Or Foe?

- Stuck In A Credit Crunch? Tribal Loans Might Be Your Lifeline

- Cash-Strapped? Tribal Loans Might Be Your Lifeline (But Read This First!)

- Cash In A Pinch: Unraveling The World Of Online Tribal Loans

- Land Of Opportunity: Unveiling The Secrets Of Indian Reservation Loans

What are Tribal Payday Lenders?

Tribal payday lenders are financial institutions that operate on tribal land. They’re often affiliated with Native American tribes, who have sovereign immunity, meaning they’re not subject to the same laws as other lenders. This is where things get tricky. Because they’re on tribal land, they can operate under different rules, sometimes skirting state regulations that limit interest rates and other loan terms.

Why Are They Controversial?

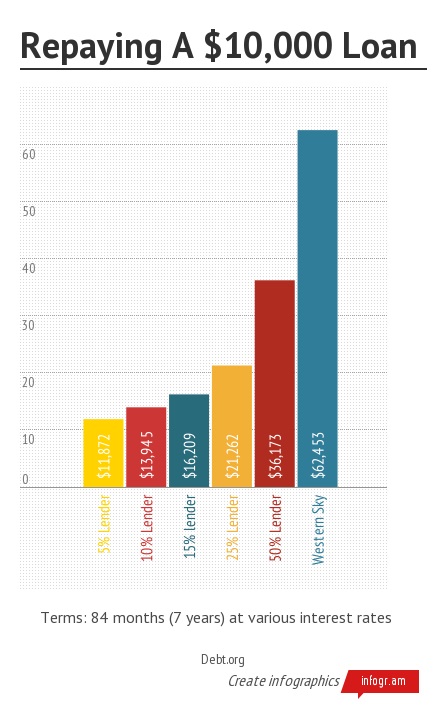

The biggest issue with tribal payday lenders is the potential for predatory lending. This means they can offer loans with exorbitant interest rates, high fees, and hidden charges, leading borrowers into a cycle of debt that’s hard to escape.

Here’s the breakdown:

- High Interest Rates: Tribal payday loans often carry interest rates of 400% or even higher, making them significantly more expensive than traditional loans.

- Short-Term Loans: These loans are designed to be repaid within a short period, usually two weeks. If you can’t repay on time, you’ll be hit with hefty fees, further deepening your debt.

- Aggressive Collection Practices: Some tribal payday lenders have been accused of using aggressive tactics to collect on unpaid loans, including harassing borrowers and threatening legal action.

The Legal Landscape

The legal landscape surrounding tribal payday lenders is complex. State regulators have struggled to enforce consumer protection laws against these lenders, who often claim immunity based on their tribal affiliation.

What’s the Solution?

It’s clear that tribal payday lenders pose a significant risk to borrowers. So, what can be done?

- Increased Regulation: Advocates for consumer protection argue for stricter regulations on tribal payday lenders, including limiting interest rates and requiring greater transparency in loan terms.

- Consumer Awareness: It’s essential for borrowers to be aware of the risks associated with tribal payday loans and to explore alternative financing options before resorting to these lenders.

- Alternative Lending Options: There are numerous alternatives to payday loans, including credit unions, community lenders, and online peer-to-peer platforms. These options often offer lower interest rates and more flexible repayment terms.

So, Should You Avoid Tribal Payday Lenders?

The answer is a resounding yes, unless you’re in a truly desperate situation. These lenders are designed to trap borrowers in a cycle of debt, and the consequences can be devastating.

Here’s a rule of thumb: If you’re considering a payday loan, no matter the source, take a step back and ask yourself:

- Can I wait? Is there a way to delay your expense and explore other options?

- Can I cut back? Are there any unnecessary expenses you can trim from your budget?

- Can I ask for help? Reach out to friends, family, or a credit counselor for support.

The Bottom Line

Tribal payday lenders are a risky business. While they may offer quick cash, they come with a high price tag and the potential for serious financial hardship. Before you take the plunge, do your research, weigh your options, and consider the long-term consequences. Your financial well-being is worth it.

FAQ About Tribal Payday Lenders

1. Are tribal payday lenders legal?

While they operate within the legal framework of tribal sovereignty, the legality of their practices is often debated. State regulators struggle to enforce consumer protection laws against them.

2. What are the risks of using a tribal payday lender?

The biggest risks include exorbitant interest rates, short-term repayment deadlines, and aggressive collection practices, which can lead to a cycle of debt.

3. How can I avoid using a tribal payday lender?

Explore alternative financing options like credit unions, community lenders, or online peer-to-peer platforms. These options often offer lower interest rates and more flexible terms.

4. What should I do if I’m already in debt with a tribal payday lender?

Contact a credit counselor or consumer protection agency for advice and assistance. They can help you navigate your options and potentially negotiate with the lender.

5. Is there any way to report a tribal payday lender for unethical practices?

You can file a complaint with the Consumer Financial Protection Bureau (CFPB), the Federal Trade Commission (FTC), or your state attorney general’s office.

Remember, financial stability is a marathon, not a sprint. Choose your lenders wisely, and always prioritize your financial well-being.

Closure

Thus, we hope this article has provided valuable insights into Cash-Strapped? The Rise of Tribal Payday Lenders and What You Need to Know. We appreciate your attention to our article. See you in our next article!