Cashing In: Navigating the World of Indian Reservation Loans Online

Cashing In: Navigating the World of Indian Reservation Loans Online

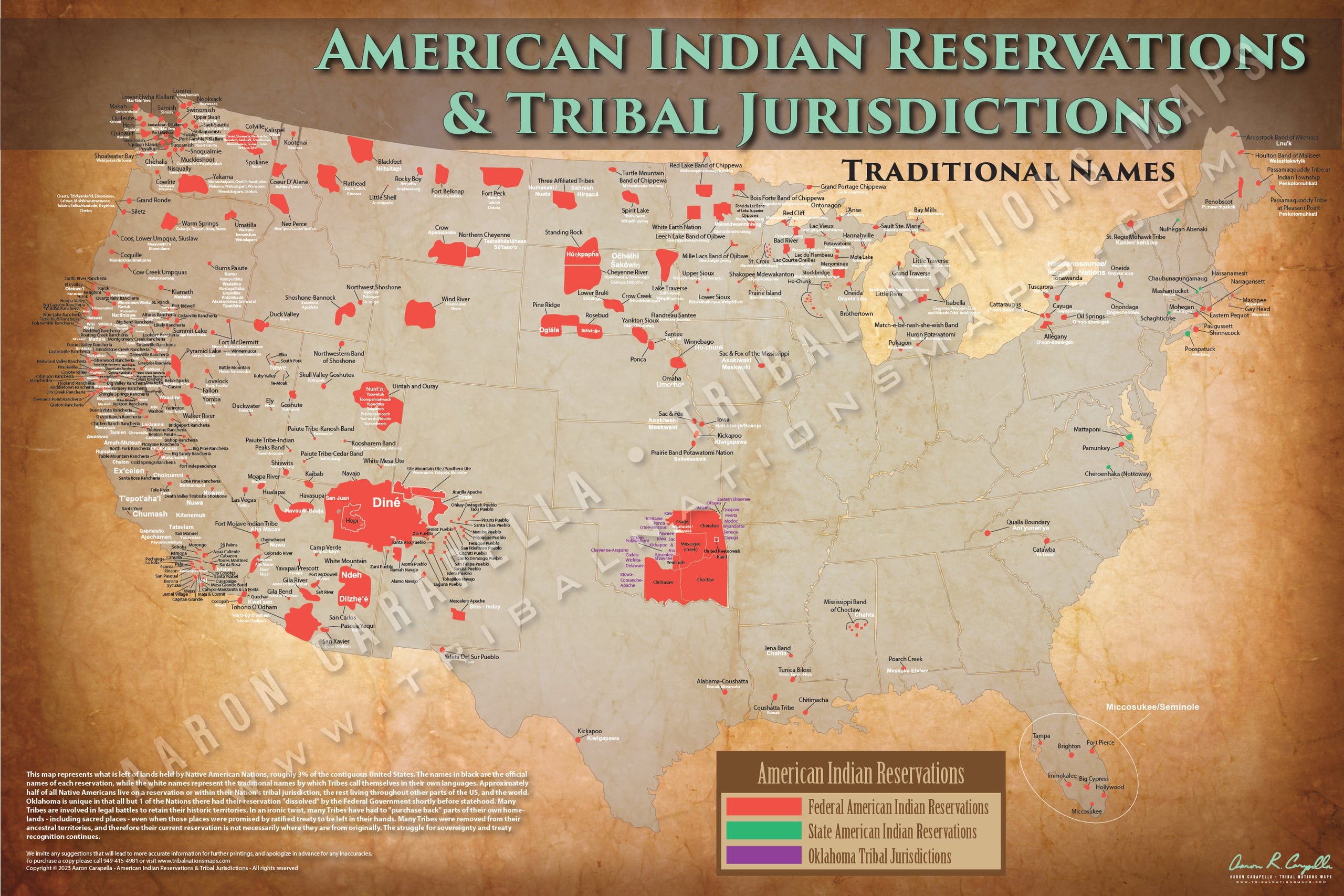

Let’s face it, money can be a real pain in the neck. Bills pile up, unexpected expenses pop up, and sometimes, you just need a little extra cash to make ends meet. If you’re a member of a federally recognized tribe and live on an Indian reservation, you might be wondering, "Are there any special loan options out there for me?" Well, you’re in luck! There are a number of online loan programs specifically designed for Native Americans, and today, we’re going to dive deep into the world of Indian Reservation loans.

What’s the Deal with Indian Reservation Loans?

Related Articles: Cashing In: Navigating the World of Indian Reservation Loans Online

- Stuck In A Bind? Tribal Installment Loans: Your Financial Lifeline?

- Cashing In: Your Guide To Indian Reservation Loan Companies

- Cash-Strapped? No Credit? No Problem! Find Online Loans Near You Without A Credit Check

- Cash In A Pinch? California Tribal Loans: The Good, The Bad, And The Ugly

- Cash-Strapped? Tribal Loans Might Be Your Lifeline (But Read This First!)

Indian Reservation loans, also known as tribal loans, are financial products offered by lenders who specifically cater to the unique needs of Native American communities. These loans can come in a variety of forms, from personal loans to business loans, and they often offer competitive rates and flexible terms compared to traditional lenders.

Why Are These Loans So Special?

You might be thinking, "Why would I need a special loan just because I live on a reservation?" Good question! Here’s the lowdown:

- Financial Sovereignty: For centuries, Native American communities have faced economic hardship due to historical injustices and a lack of access to capital. Tribal loans are a way to promote financial independence and sovereignty within these communities.

- Understanding Cultural Needs: Traditional lenders might not always grasp the specific financial needs of Native Americans. Tribal lenders, on the other hand, are more likely to understand the cultural nuances and economic realities of reservation life.

- Building Community Wealth: Tribal loans are often invested in local businesses, creating jobs and boosting the economy within the reservation.

Types of Indian Reservation Loans

So, what kind of loans are we talking about? Here’s a breakdown of the most common types:

- Personal Loans: These loans are perfect for covering unexpected expenses, like car repairs, medical bills, or home improvements.

- Business Loans: Need a boost for your small business? Tribal business loans can help you get started, expand your operations, or manage cash flow.

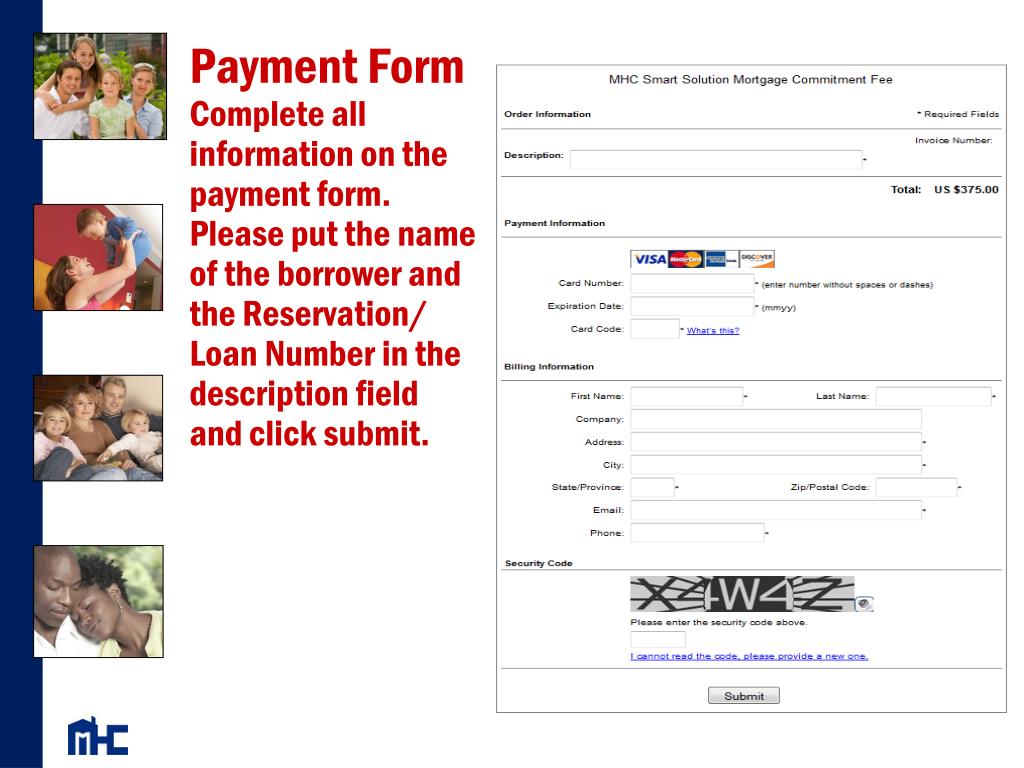

- Home Loans: Buying a home on the reservation can be a challenge. Tribal home loans offer competitive rates and flexible terms to make homeownership a reality.

- Student Loans: Financing your education is a big deal. Tribal student loans can help you cover tuition, fees, and living expenses.

Finding the Right Loan for You

Okay, so you’re convinced that Indian Reservation loans are worth exploring. But how do you find the right lender? Here are some tips:

- Start with Your Tribe: Many tribes have their own lending programs or partnerships with lenders. Check with your tribal government or economic development office.

- Explore Online Resources: There are several websites and organizations that specialize in connecting Native Americans with tribal lenders. A quick Google search can lead you to a wealth of information.

- Read Reviews and Compare Rates: Just like with any financial product, it’s important to compare rates, terms, and fees. Read reviews from other borrowers to get a sense of the lender’s reputation.

The Fine Print: What You Need to Know

Before you jump into applying for a loan, there are a few things you should keep in mind:

- Credit Score: Like most loans, your credit score will play a role in determining your interest rate and loan terms. Building good credit is crucial!

- Income Requirements: Lenders will typically require proof of income to ensure you can repay the loan.

- Fees and Interest Rates: Make sure you understand all the fees associated with the loan, including origination fees, late payment fees, and interest rates.

- Loan Terms: Pay close attention to the loan term, or the length of time you have to repay the loan. Longer terms can lead to lower monthly payments but might also result in higher overall interest costs.

The Bottom Line: Is It Worth It?

So, are Indian Reservation loans right for you? The answer depends on your individual circumstances. If you’re a member of a federally recognized tribe and need a loan, it’s definitely worth exploring your options. These loans can offer competitive rates, flexible terms, and a commitment to supporting Native American communities.

FAQ: Indian Reservation Loans Online

Q: Do I have to live on the reservation to qualify for a loan?

A: While most tribal lenders prefer borrowers who live on the reservation, some may be open to lending to members who live off-reservation. It’s best to contact the lender directly to inquire about their specific eligibility requirements.

Q: What kind of documentation do I need to apply for a loan?

A: Typical documentation includes proof of identity, income, residency, and tribal enrollment. Specific requirements will vary depending on the lender and loan type.

Q: How long does it take to get approved for a loan?

A: The approval process can vary depending on the lender and the complexity of your application. It’s always a good idea to apply well in advance of your need for funds.

Q: What happens if I can’t repay my loan?

A: If you’re struggling to repay your loan, it’s important to contact your lender as soon as possible. They may be able to work with you to create a repayment plan that fits your budget.

Q: Are there any scams or predatory lenders I should be aware of?

A: Unfortunately, there are always unscrupulous individuals who prey on vulnerable populations. Be cautious of lenders who offer incredibly low rates or who pressure you into signing contracts without fully understanding the terms. Always research a lender thoroughly before applying for a loan.

Final Thoughts

Navigating the world of finance can be a daunting task, especially when you’re looking for specialized loans. But by understanding the unique benefits of Indian Reservation loans and taking the time to research your options, you can find the financial support you need to achieve your goals. Remember, knowledge is power, and when it comes to your finances, it’s always best to be informed!

Closure

Thus, we hope this article has provided valuable insights into Cashing In: Navigating the World of Indian Reservation Loans Online. We appreciate your attention to our article. See you in our next article!